Our social circles often shape who we are, influencing everything from our daily habits to our worldview. Among the most significant ways friends affect us is through our approach to finances. Financial attitudes and behaviors, including spending habits, saving tendencies, and risk tolerance, are not solely personal decisions—the people around us frequently shape them.

Understanding how friends influence your financial attitudes and behaviors can help you make more intentional decisions about your finances. Here’s a closer look at the dynamics at play, the ways in which friends shape our financial lives, and how to build a network that supports your financial well-being.

The Social Aspect of Financial Decisions

Humans are naturally social creatures, and much of what we do is influenced by our desire to fit in or be accepted by others. Psychologists have observed that behaviors often spread through social networks, much like a virus. This phenomenon, called “behavioral contagion,” suggests that if your friends have certain attitudes toward money, these views are likely to influence your own.

Friends can affect your financial behaviors in several ways:

- Peer Influence on Spending and Saving

If your friends prioritize lavish outings and expensive purchases, you may feel an unspoken pressure to do the same. Peer pressure isn’t always explicit; simply observing friends who are free spenders can encourage similar behaviors. For example, if everyone in your friend group regularly dines at high-end restaurants, you may feel compelled to join in to maintain a sense of belonging. On the other hand, friends who are budget-conscious and prefer low-cost activities can positively influence you toward mindful spending and saving. - Shared Financial Goals and Aspirations

Friends often inspire each other to set similar life goals, including financial ones. If a close friend starts saving for a home, you may feel motivated to do the same. Financial aspirations—such as paying off debt, saving for travel, or starting an investment portfolio—can be contagious. Having a friend who has achieved financial milestones can serve as a powerful motivator, encouraging you to adopt similar financial habits. - Risk Tolerance and Investment Choices

Friends can also shape your attitude toward financial risks. If your friends are cautious with their money, preferring low-risk investments, you might feel more inclined to do the same. Conversely, if you surround yourself with friends who actively invest in stocks, cryptocurrency, or other high-risk ventures, you may feel more confident taking similar financial risks. Social proof can make us feel more comfortable taking on risks we might otherwise avoid if we see those around us doing it successfully. - Financial Conversations and Knowledge Sharing

Friends can influence financial behavior by openly sharing information and advice about money. When friends discuss their financial experiences, including successes and challenges, it opens the door to financial literacy. For instance, if a friend shares their experience with budgeting apps, investment strategies, or loan repayment plans, it may inspire you to explore these options as well. Financial literacy can be contagious within friend groups, with knowledge and best practices often spreading organically. - Impact of Financial Support Systems

Friends can also serve as a financial support system, both emotionally and practically. Having friends who discuss their struggles with debt, for example, may help normalize financial difficulties and reduce feelings of isolation. Friends can provide advice, resources, or moral support when facing financial hardships, helping you feel empowered to make positive changes. The support of friends can make the journey toward financial wellness feel less daunting and more achievable.

Positive and Negative Influences of Friends on Finances

While friends can be a source of motivation and support, they can also have a negative impact on financial behaviors.

- Positive Influences

When friends exhibit healthy financial habits, such as budgeting, saving, or investing wisely, they set a positive example. Positive financial influences can make responsible money management seem accessible and rewarding. Friends who prioritize their financial health can inspire you to set achievable goals, helping you stay on track with your own finances. - Negative Influences

On the other hand, friends with poor financial habits can create negative influences. If friends frequently spend beyond their means, are reluctant to budget, or make impulsive financial decisions, it’s easy to fall into the same patterns. Keeping up with friends’ expensive habits can lead to debt, stress, and financial instability if left unchecked.

How to Build a Financially Supportive Social Circle

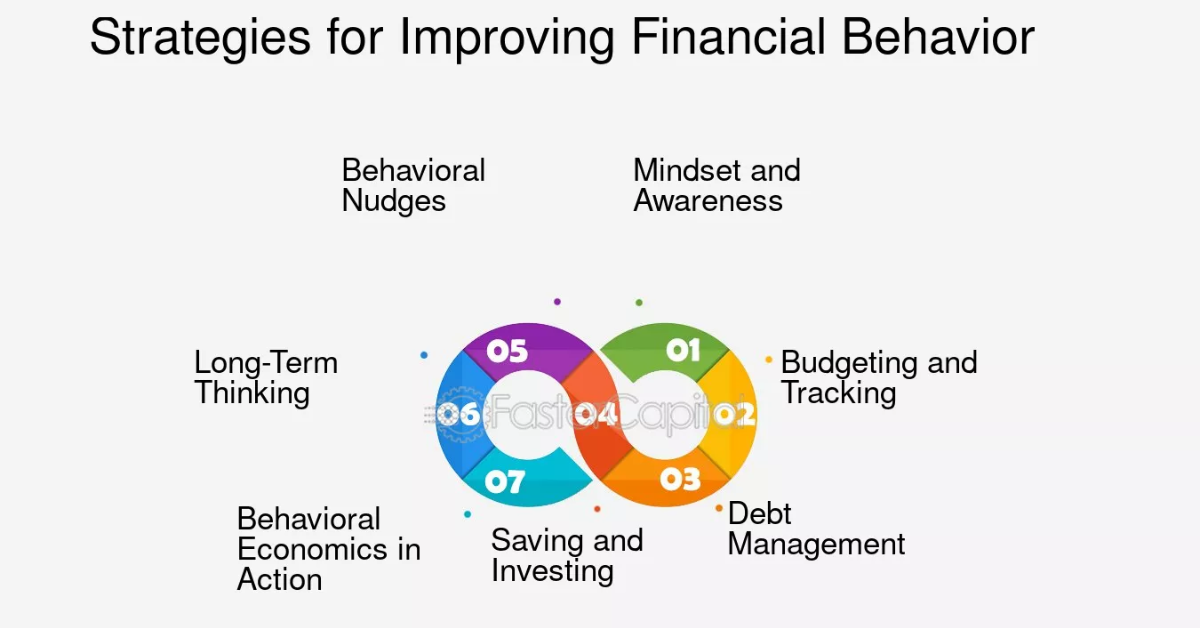

To harness the positive effects and mitigate the negative influences of friendships on your finances, consider these tips:

- Choose Financially Like-Minded Friends

While diversity in social circles is valuable, having friends who share similar financial goals or values can reinforce positive financial behaviors. Seek out friends who prioritize financial wellness and encourage each other toward financial independence. - Initiate Honest Financial Conversations

Talking openly about finances with trusted friends can help demystify money management and normalize financial challenges. Discussing goals, setbacks, and successes openly can be beneficial for everyone in your social circle, fostering a supportive environment for responsible financial habits. - Set Boundaries to Avoid Peer Pressure

Establish clear financial boundaries if you find yourself under pressure to keep up with friends’ spending habits. Politely suggest alternative, low-cost activities if a friend group tends to overspend. Most friends will understand and support you when they know you’re committed to reaching your financial goals. - Join Financially Focused Groups or Communities

Joining a financial literacy group or community can provide access to people with similar financial values, further reinforcing positive behaviors. Many communities provide mentorship, education, and resources that can help you build strong financial habits.